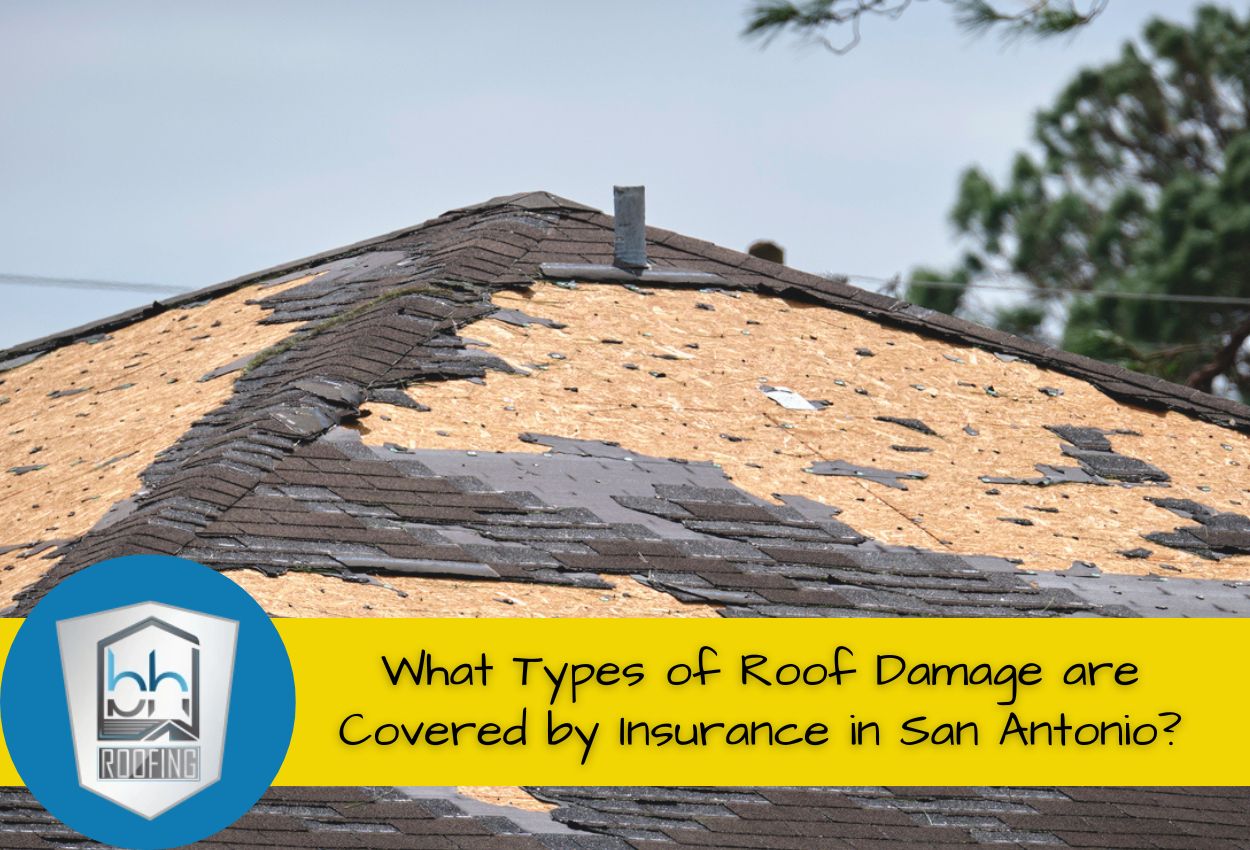

Any time a storm moves through San Antonio, one of the first questions homeowners ask is what kinds of roof damage covered by insurance in San Antonio actually qualify for a claim. Most people think insurance will automatically pay for anything that happens to the roof, but that’s not always the case. Carriers look closely at how the damage occurred, the age of the roof, the type of materials installed, and whether the problem happened suddenly or developed over time. Understanding what insurance typically covers can help homeowners make smarter decisions and avoid surprise out-of-pocket costs.

Many families don’t realize that some roof damage isn’t visible until weeks after a storm. Small hail impacts can bruise shingles, wind can lift edges without tearing them, and flying debris can create tiny punctures that lead to leaks later. Even if the roof looks fine from the ground, an inspection can reveal storm-related problems that qualify for coverage. The challenge is knowing which signs count as “covered damage” and which ones insurance may consider wear and tear.

Storm Damage: When Insurance Has You Covered

The good news for homeowners is that most insurance policies cover specific types of storm damage that are common in South Texas. Wind damage roof insurance coverage typically includes repair costs for shingles blown off during severe storms, broken tree limbs damaging roof structures, and structural compromise from high-speed gusts that frequently hit San Antonio.

Hail damage covered by insurance generally encompasses cracked shingles, dents in metal roofing panels, and compromised roof integrity that allows water intrusion. Lightning strikes that cause roof fires or electrical system damage are also covered under most homeowners insurance roof coverage plans. While standard policies usually exclude flooding, they do cover water damage resulting from roof breaches during storms.

To strengthen your storm damage roof insurance claims, documentation is essential. Take date-stamped photos of all visible damage immediately after the storm, when it is safe to do so. Keep records of any emergency repairs and save samples of damaged materials. Document all communication with your insurance company, including claim numbers and adjuster information.

Remember that insurance adjusters look for clear evidence linking the damage to a specific storm event. Having a professional roofing contractor assess and document the damage can significantly improve your chances of claim approval, as they can identify subtle storm damage that untrained eyes might miss.

Hail Damage Insurance Coverage Explained

Hailstorms in San Antonio can wreak havoc on residential roofing systems, causing damage that ranges from obvious to nearly invisible. Insurance companies recognize specific signs when evaluating hail damage claims. Visible indicators include cracked or missing shingles, dents in metal vents or flashing, and granule loss creating bald spots on asphalt shingles. Hidden damage often includes weakened shingle mat foundations, compromised waterproof seals, and microscopic cracks that allow moisture in over time.

Insurance adjusters assess hail damage severity using standardized criteria. They typically count the number of hail impacts within sample areas, usually 10-by-10-foot sections, across different slopes of your roof. Most insurers require finding multiple hail hits per sample area to qualify for a claim. The size of hailstones also matters significantly — damage from stones smaller than quarter-size may be denied unless they caused clear functional damage.

For San Antonio homeowners, understanding the threshold between repair and replacement is crucial. When hail damage affects less than 30% of your roof, insurers typically approve partial repairs. However, when damage extends beyond this threshold or compromises the roof’s structural integrity, full replacement becomes more likely. Insurance companies also consider your roof’s age and pre-storm condition when determining coverage limitations and depreciation factors in their settlement offers.

Wind Damage: What Your Policy Protects

Wind damage is one of the most common reasons San Antonio homeowners file roof insurance claims. Standard homeowners insurance policies typically cover wind-related roof damage ranging from small issues like displaced or missing shingles to severe structural problems, including torn underlayment, damaged decking, or collapsed sections. When powerful Texas storms hit, your insurance should cover repair or replacement costs for legitimately wind-damaged roofing components.

Most insurance companies use specific wind speed thresholds to determine coverage eligibility. While policies vary, damage typically becomes coverable when winds exceed 50 to 60 mph. Weather data plays a crucial role in claims processes, as adjusters verify reported damage against local weather records to confirm wind speeds reached damaging levels. Insurance companies distinguish between damage caused by actual weather events vs. pre-existing issues or neglected maintenance.

Insurance adjusters look for specific wind damage patterns like lifted shingle edges, diagonal damage lines, or uniformly affected areas facing the same direction. They also evaluate whether damage resulted from installation practices or manufacturing defects vs. legitimate storm damage. San Antonio homeowners should document all wind damage immediately after storms and schedule professional roof inspections to identify covered damage patterns that support successful claims.

Fire and Smoke Damage to Roofing Systems

When fire affects your home, the roof often bears significant damage that extends beyond visible burns. Most homeowners insurance policies cover both direct fire damage to roofing systems and the less obvious smoke damage that compromises materials over time. Direct fire damage typically results in charred structural components, melted shingles, and weakened support systems that require immediate attention. Even without direct flames, extreme heat can warp metal components, distort shingles, and compromise the roof’s structural integrity.

Smoke damage presents more subtle but equally concerning issues for San Antonio roofs. Acidic smoke residue can deteriorate roofing materials, corrode metal flashings, and infiltrate attic spaces. While this damage might not be immediately visible, it often leads to premature aging of roofing materials and potential leaks months after the original fire. Most insurance policies cover professional cleaning and restoration of smoke-affected roofing components when properly documented.

Texas homeowners should pay particular attention to chimney-related roof damage coverage in their policies. Many insurers require regular chimney maintenance to maintain coverage for related fire incidents. For properties in wildfire-prone areas around San Antonio, some insurance providers offer enhanced coverage options for fire-resistant roofing materials and preventive measures. Having your roof professionally inspected after any fire event, even neighboring fires, ensures you identify all covered damage before it worsens into more serious structural issues.

Navigating the Roof Insurance Claim Process

Filing a successful roof insurance claim requires understanding the steps and documentation needed to secure coverage for your damaged roof. The process begins with an inspection of your roof after the storm or damage event. While you can perform an initial assessment from the ground using binoculars, having a professional San Antonio roofing contractor conduct a comprehensive evaluation provides the detailed documentation insurance companies require.

Once damage is confirmed, contact your insurance company promptly to report the claim, as most policies have strict deadlines for filing. When speaking with your insurance adjuster, ask about your coverage, applicable deductibles, and the documentation needed for your claim. Keep detailed notes of all conversations, including dates, names, and key points discussed.

When the insurance adjuster schedules their inspection, have a physical copy of the inspection report from your roofing contractor with you. Professional roofers can point out damage that adjusters might miss and provide technical explanations that strengthen your claim. After the inspection, your insurance company will provide a settlement offer based on their assessment of the covered damages. If you disagree with the assessment, you have the right to request a second inspection or file an appeal with supporting documentation from your roofing professional.

Age-Related Considerations and Roof Replacement Coverage

As your roof ages, insurance coverage becomes more complex and often limited. Most insurance companies in San Antonio adjust their coverage based on roof age, with many policies shifting from replacement cost value (RCV) to actual cash value (ACV) once a roof exceeds 10 to 15 years. This transition means older roofs are subject to depreciation calculations during claims, potentially leaving homeowners responsible for a significant portion of replacement costs.

Insurance providers typically assess roof age alongside condition when determining coverage. A well-maintained 15-year-old roof might receive better coverage terms than a neglected 8-year-old roof with visible deterioration. Most insurers require documentation of regular maintenance to maintain full coverage on aging roofs. This might include proof of professional inspections, repairs, and preventive maintenance like coatings.

San Antonio homeowners with older roofs can maximize their coverage with several strategies. First, schedule annual professional inspections to document your roof’s condition and fix minor issues. Second, inquire about policy endorsements specifically designed for older roofs. Many insurance companies offer optional coverage additions that maintain replacement cost benefits for well-maintained older roofing systems, although these typically come with premium increases.

When deciding between repair and replacement claims, generally, if damage affects more than 25% of the roof, a full replacement becomes more cost-effective and is more likely to be approved, even for older roofs. Understanding these age-related considerations helps homeowners make decisions about maintaining appropriate coverage as their roofing systems age.

Expert Roof Repair and Replacement by BH Roofing

Understanding your insurance coverage for roof damage is crucial, especially in areas prone to severe weather like San Antonio. If you’re facing roof damage from storms, hail, or other covered events, it’s important to act quickly. BH Roofing specializes in assessing and repairing roof damage that your insurance typically covers.

Call BH Roofing at (210) 267-9029 today for a storm damage roof inspection. Our experienced team will guide you through the repair process, helping you understand what is covered under your policy and ensuring your roof is restored to top condition with minimal hassle. Let us help you protect your home effectively.