When hailstorms strike San Antonio homes, knowing how to file an insurance claim for hail damage is essential for homeowners seeking compensation for repairs. Hail can cause significant damage to roofs, siding, windows, and other exterior elements of your property, and this damage often qualifies for insurance coverage. Most insurance policies require homeowners to file claims within a specific timeframe after the storm, typically 30 to 60 days, making immediate action critical to successful claims.

Standard homeowners insurance policies in Texas generally cover hail damage to roofs and other structures, but understanding your specific coverage details matters. Texas insurance policies often include separate wind and hail deductibles that differ from your standard deductible amount. These specialized deductibles typically range from 1% to 5% of your home’s insured value rather than a fixed dollar amount, which can significantly impact your out-of-pocket expenses.

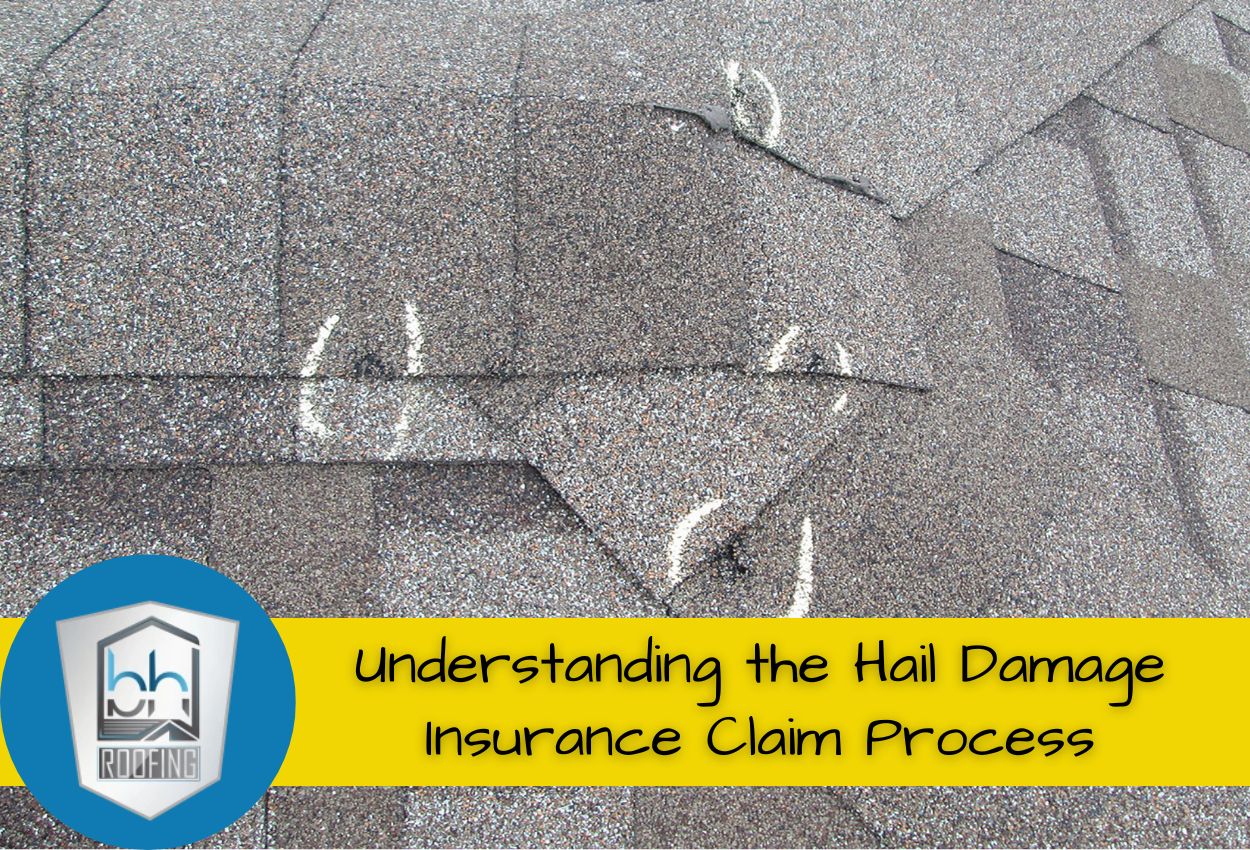

Before beginning the claims process, it’s important to recognize what qualifies as insurable hail damage. Insurance companies look for specific indicators such as granule loss on asphalt shingles, dents in metal components, cracked tiles, or damaged vents and flashing. Professional roof inspections from qualified San Antonio roofing contractors can identify these damages and provide documentation such as a complete inspection report.

Immediate Steps to Take After a Hailstorm

Once the hailstorm has passed over your San Antonio home, taking swift action is necessary for a successful insurance claim. Begin by noting the exact date and time of the storm, as this information will be crucial when filing your claim and can be verified through local weather reports. Wait until authorities confirm it’s safe to go outside before attempting a damage assessment.

When inspecting your property, prioritize your safety above all else. Avoid climbing on the roof or handling broken glass without proper equipment. Instead, conduct a ground-level assessment first, using binoculars to examine your roof for missing shingles, dents in gutters, or damaged vents. Document everything with clear, well-lit photographs that show the extent and location of the damage.

Create a detailed inventory of all affected items, including your roof, siding, windows, outdoor furniture, and vehicles. Take close-up photos of hail damage such as dents, cracks, or granule loss on shingles. If emergency repairs are necessary to prevent water intrusion, photograph the damage thoroughly before making temporary fixes, and save all receipts for materials purchased.

Many San Antonio homeowners make the mistake of initiating repairs before proper documentation, potentially compromising their claims. Remember that professional roof inspections provide the most comprehensive evidence for insurance purposes and help identify damage that might not be visible to untrained eyes.

How to Document Your Hail Damage Effectively

Proper documentation is the backbone of successful hail damage insurance claims. Insurance companies require clear evidence before approving roof repairs, and the quality of your documentation directly impacts claim outcomes. The right photographic techniques can make a significant difference in how adjusters perceive the damage to your San Antonio home.

When photographing hail damage, timing and lighting are crucial. Capture images during the morning or late afternoon when sunlight falls at an angle across your roof, creating shadows that highlight dents and indentations. Take wide-angle shots of the entire roof first, then progressively zoom in on specific damaged areas. For granule loss on asphalt shingles, close-up shots showing the exposed substrate can be especially compelling to insurance adjusters.

Other than photographs, develop a comprehensive damage report with exact measurements of dented areas and impact sizes. Use a ruler or tape measure visible in photos to provide scale reference. Organize digital files by location (north side of the roof vs. south side, etc.) and damage type, creating a record that’s difficult for insurance companies to dispute. Include timestamps on all documentation and correlate these with official weather reports confirming hail in your area.

Professional roofing contractors in San Antonio often use specialized tools during inspections, including damage mapping software that provides insurance companies with irrefutable evidence of hail impacts. This technological approach to documentation, combined with your personal records, creates a strong case that maximizes your chances for full coverage of necessary repairs.

Benefits of Working With Professional Roof Inspectors

Partnering with qualified San Antonio roofing contractors for a professional inspection is a crucial step in the hail damage insurance claim process. Look for contractors with valid licensing, insurance, and certifications from leading roofing manufacturers like Tamko (like us). Before scheduling an assessment, ask potential inspectors about their process for documenting damage and whether they can provide references from previous hail damage projects in the area.

When reviewing credentials, verify that your chosen contractor maintains general liability insurance and workers’ compensation coverage. Established roofing professionals will provide these documents upon request. During your initial conversation, ask about their familiarity with local building codes and roofing materials that can withstand Texas weather events.

Once you receive the inspection report, you might see terminology like “impact marks,” “bruising,” “fracturing,” or “thermal cracking.” These technical terms describe specific types of hail damage that affect your roof’s integrity. Professional reports typically include detailed photographs, measurements of damaged areas, and an assessment of your roof’s remaining service life. These elements provide insurance adjusters with the technical evidence needed to approve your claim. The report should clearly distinguish between pre-existing conditions and new storm damage, stopping any potential objections from your insurance company before they arise.

What to Expect When the Insurance Adjuster Visits

When your insurance adjuster schedules an inspection following your hail damage claim, preparation can significantly influence the outcome. Plan to be present during this assessment, as your involvement demonstrates a commitment to the process and ensures nothing is overlooked. Before the adjuster arrives, gather all documentation, including your inspection report from your San Antonio roofing contractor, photographs, weather reports, and any emergency repair receipts.

During the inspection, accompany the adjuster around your property, pointing out all documented damage areas. Be specific when describing when and how the damage occurred. Watch for what the adjuster focuses on, they’re typically looking for consistent patterns of impact marks, damaged roof components, and signs that distinguish hail damage from normal wear and tear. If something is unclear, ask questions about their observations, but avoid making definitive statements about repair costs or coverage decisions.

If you disagree with the adjuster’s assessment, address concerns respectfully by referencing your professional inspection report. Remember that adjusters evaluate hundreds of properties and may miss damage that’s obvious to you or your contractor. If the assessment seems incomplete, you have the right to request a second opinion from another adjuster. It’s important for homeowners to advocate for thorough damage evaluations, which can help secure the roof repairs they deserve.

Filing Your Claim: Paperwork and Procedures

The hail damage claim filing process requires attention to detail and careful documentation to maximize your chances of approval. Start by contacting your insurance company through their claims hotline or online portal to initiate your claim. Most Texas insurers require a written notice of claim that includes your policy number, date of the hailstorm, and a general description of damages. Be prepared to complete a Proof of Loss form, which requires detailed information about damaged property and estimated repair costs.

When submitting your claim, include your professional roof inspection report, all photographs, weather data confirming hail in your area, repair estimates from reputable San Antonio roofing contractors, and receipts for any emergency repairs. Avoid common mistakes like missing submission deadlines, providing vague damage descriptions, or failing to include adequate supporting documentation. Always keep copies of everything you submit and maintain a log of all communications with your insurance company.

In Texas, insurance companies must acknowledge your claim within 15 days of receipt and make a decision within 15 business days after receiving all necessary documentation. If your claim seems delayed, follow up with a written inquiry referencing these timelines. You have the right to request updates on your claim status, and insurers must respond within reasonable timeframes. For complex hail damage claims, especially those involving extensive roof repairs, the process may take longer, but regular communication with your claims adjuster helps prevent unnecessary delays and ensures your San Antonio home receives the repairs it needs.

Claim Outcomes and Next Steps

After the insurance company processes your hail damage claim, understanding the settlement offer is essential before proceeding with roof repairs. When you receive your settlement documents, carefully review the itemized list of covered damages to ensure it matches the full scope of repairs needed for your San Antonio home. The payment summary will typically separate structural damage (like your roof) from personal property damages and will clearly indicate your deductible amount.

Before accepting any settlement, compare the insurance company’s repair estimate with quotes from reputable San Antonio roofing contractors. Look for discrepancies in material quantities, labor costs, or excluded items. Some insurance payments come in multiple disbursements: an initial payment for the actual cash value (depreciated amount), followed by the recoverable depreciation after repairs are completed with proper documentation.

If your claim is denied or underpaid, you have several options. First, request a written explanation detailing the specific reasons for denial. You can file an appeal with additional documentation from your roofing contractor showing evidence of hail damage. Texas insurance regulations allow you to demand an appraisal if you disagree with the settlement amount, a process where independent experts evaluate the damage. In cases of significant discrepancies, consider hiring a public adjuster who specializes in representing homeowners during disputed claims. Remember that Texas law prohibits insurance companies from retaliating against policyholders who file legitimate hail damage claims.

Expert Roof Inspection in San Antonio

If you’ve recently experienced a hailstorm in San Antonio, acting swiftly can be crucial for your property’s integrity and insurance claims. BH Roofing specializes in comprehensive roof inspections that not only assess the extent of hail damage but also help in documenting it effectively for your insurance claims. Understanding the nuances of hail damage and its impact on your roof can significantly influence the success of your claim.

Call BH Roofing today at (210) 267-9029 to schedule your roof inspection. Don’t wait until it’s too late, secure your home and your peace of mind today.